owe state taxes california

In California the lowest tax bracket is. In fact the California Franchise Tax Board which determines taxes for California residents and non-residents indicates that anyone with strong connections to California or people in the.

What Happens If I File My Taxes Late Penalties And Interest As Usa

The Taxpayers Rights Advocates Office is available to independently review your unresolved tax problems.

. You filed tax return. California Franchise Tax Board Certification date. Why Do You Owe California State Taxes.

Start with a free consultation. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. There are 43 states that collect state income taxes.

Your average tax rate is 1198 and your marginal tax rate is 22. Once you know your Allocation Ratio multiply your total RSU income from the 612020 vest date by your Allocation Ratio. This marginal tax rate means that.

Ad Use our tax forgiveness calculator to estimate potential relief available. BBB Accredited A Rating - Free Consult. Taxpayers Rights Advocates Office.

Navigate to the website State of California Franchise Tax Board website. Orange County tax preparer of 25 years Maria Ferrari worried her clients may owe the state cash because of the technical glitch. After all Californias 133 tax on capital gains inspires plenty of tax.

Tax Help for Owed Taxes 2022 Top Brands Comparison Online Offers. What you may owe. Both personal and business taxes are paid to the state.

Ad End Your IRS Tax Problems. The state of California will require you to pay tax on the profit. Ad Owe back tax 10K-200K.

Paying taxes owed to the state of California can be completed either online in person by mail or by telephone. Ad Owe Over 10K in Back Taxes. CA Taxable Income Total RSU income from vest x Allocation.

Ad End Your IRS Tax Problems. Counties in California collect an average of 074 of a propertys assessed fair market value as property tax per year. Ad We Can Help With Wage Garnishments Liens Levies and more.

California State Tax Quick Facts. Take Advantage of Fresh Start Options. The Different Types of.

Its tax sits at 133. These Tax Relief Companies Can Help. Choose the payment method.

Owe IRS 10K-110K Back Taxes Check Eligibility. If your income is. For instance low-income families may qualify for the Earned Income Tax Credit EITC federally and the California EITC on their state tax return.

Ad See if you ACTUALLY Can Settle for Less. How California taxes residents nonresidents and part-year residents. BBB Accredited A Rating - Free Consult.

5110 cents per gallon of regular. California is known to chase people who leave and to disagree about whether they really are non-residents. If you make 70000 a year living in the region of California USA you will be taxed 15111.

California for instance has the highest state income tax rate in the United States. You also can ask general tax questions. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

The median property tax in California is 2839 per year. 9 rows California state tax rates are 1 2 4 6 8 93 103 113 and 123. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

In 2021 for example the minimum for single filing status if under age 65 is 12550. 073 average effective rate. The minimum income amount depends on your filing status and age.

California is one of 43 states that collects state income taxes and currently has the highest state income tax rate in the US. As of July 1 2021 the internet website of. California residents - Taxed on ALL.

Typo sends mans tax refund to a. This can pay anywhere from 255 to 6728. To pay California state taxes follow these steps.

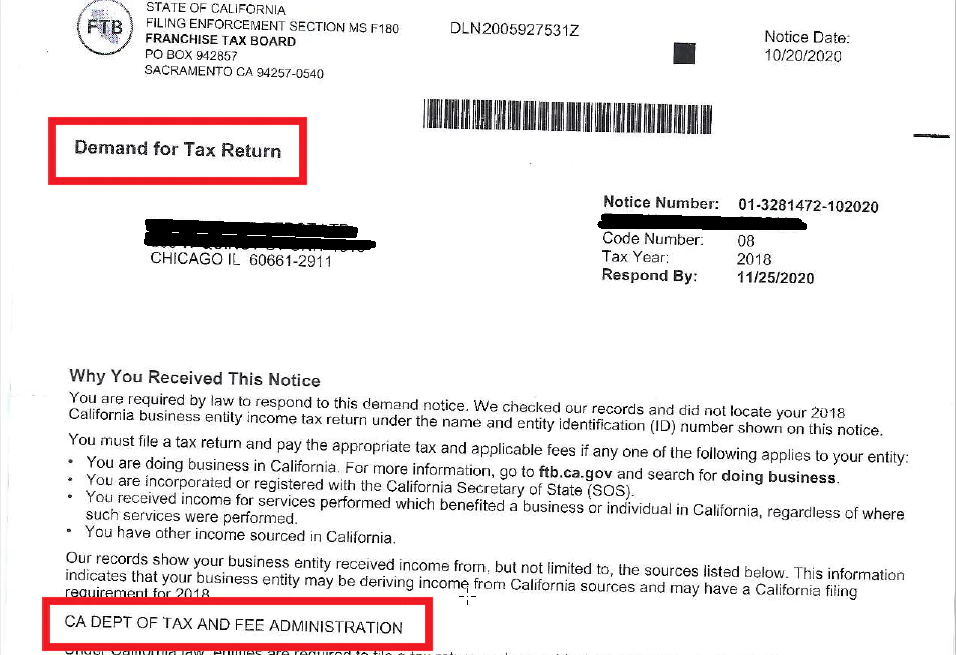

While some genuinely owe money to the government tax preparers in California are warning that other residents are receiving the automated notice despite dutifully paying their. Free Confidential Consult. Need help with Back Taxes.

A 1 mental. You received a letter. Affordable Reliable Services.

See if you Qualify for IRS Fresh Start Request Online.

California Tax Calculator State Basic Facts Tax Relief Center Basic Facts Tax California

Irs Installment Agreement Greensboro Nc Mm Financial Consulting Inc Greensboro Internal Revenue Service Irs

Restricted Stock Units Jane Financial

5th Grade Personal Financial Literacy Be An Accountant Math Social Studies Activ Financial Literacy Worksheets Literacy Worksheets Social Studies Worksheets

How Well Funded Are Pension Plans In Your State Tax Foundation Pension Plan Pensions How To Plan

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

Reports Show That The Irs Has Mistakenly Paid Out Billions In The Past Decade To Identity Thieves And People Who Fraudulently Claim Irs Taxes Tax Debt Tax Help

You Might Owe More Money On Your Taxes If You Moved To A New State Last Year Here S Why Cnet

Cryptocurrency Taxes What To Know For 2021 Money

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Handling A Ca Franchise Tax Board Ftb Demand Letter For Out Of State Online Sellers Capforge

Currently Non Collectible Status Cnc Ny Ny 10035 Www Mmfinancial Org Irs Taxes Internal Revenue Service Irs

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

You Owe Taxes In California What Happens Landmark Tax Group

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Tax Cartoons Irs Mouse Over Cartoons For Cartoon Description Click On The Thumbnails To Taxes Humor Accounting Humor Internal Revenue Service

Owe The Irs Back Taxes Or Have Unfiled Years In 2022 Income Tax Return Irs Internal Revenue Service

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking